Meta Platforms, Inc. (META) has been a household name in the tech industry, particularly with its flagship platform, Facebook. As a leading technology company, Meta has been at the forefront of innovation, shaping the way people interact, communicate, and access information. In this article, we will delve into the world of Meta Platforms, exploring its stock price, overview, and providing an in-depth stock analysis.

Company Overview

Meta Platforms, Inc. is a technology company that operates several well-known platforms, including Facebook, Instagram, and WhatsApp. Founded in 2004 by Mark Zuckerberg, the company has grown exponentially, with a global user base of over 2.7 billion people. Meta's primary focus is on building technologies that help people connect, find communities, and grow businesses.

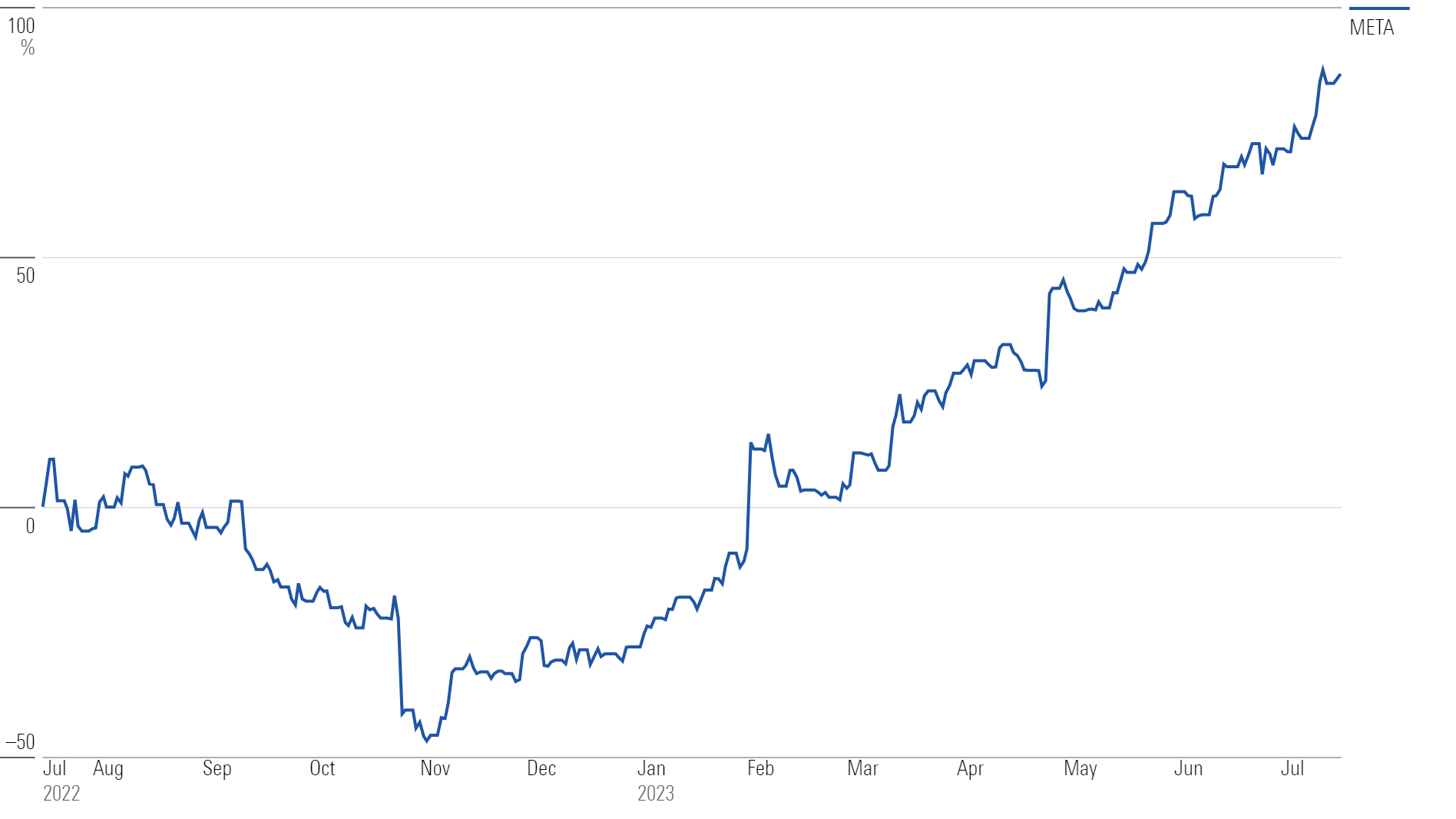

Stock Price and Performance

As of the latest market data, Meta Platforms' stock price has been experiencing fluctuations, influenced by various market and economic factors. The stock has faced challenges, including increased competition, regulatory scrutiny, and concerns over data privacy. However, with a strong track record of innovation and a loyal user base, Meta's stock has the potential for long-term growth.

Currently, the stock is trading at around $250 per share, with a market capitalization of over $750 billion. Despite the recent downturn, Meta's stock has shown resilience, with a 12-month high of over $380 per share. Investors and analysts are closely watching the company's future developments, including its foray into emerging technologies like virtual and augmented reality.

Stock Analysis

When evaluating Meta Platforms' stock, several key factors come into play. Here are a few points to consider:

Revenue Growth: Meta's revenue has consistently grown over the years, driven by its dominant position in the digital advertising market. The company's ability to innovate and expand its offerings will be crucial in maintaining revenue growth.

Competition: The tech industry is highly competitive, with players like Google, Amazon, and Apple vying for market share. Meta must continue to innovate and adapt to changing consumer behaviors to stay ahead.

Regulatory Environment: Meta faces regulatory challenges, particularly regarding data privacy and antitrust concerns. The company must navigate these challenges to maintain its market position.

Innovation: Meta's investment in emerging technologies like virtual and augmented reality, as well as its focus on e-commerce and online payments, presents opportunities for future growth.

Meta Platforms, Inc. is a complex and multifaceted company, with a rich history of innovation and growth. While the stock price has faced challenges, the company's strong track record and loyal user base provide a solid foundation for long-term growth. As the tech industry continues to evolve, Meta's ability to adapt and innovate will be crucial in determining its future success.

For investors and analysts, a comprehensive stock analysis of Meta Platforms requires careful consideration of various factors, including revenue growth, competition, regulatory environment, and innovation. By staying informed and up-to-date on the latest developments, investors can make informed decisions about adding Meta to their portfolio.

With its strong brand, loyal user base, and commitment to innovation, Meta Platforms, Inc. is an exciting company to watch in the tech industry. As the company continues to shape the future of technology, its stock price and performance will be closely monitored by investors and analysts alike.

Note: This article is for informational purposes only and should not be considered as investment advice. It's essential to consult with a financial advisor or conduct your own research before making any investment decisions.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/HRSC3X63VRMMLLTNUUACKB42AA.jpg)