As the open enrollment window for Medicare approaches, it's essential to understand the factors that affect your premium costs. One crucial aspect to consider is the Income-Related Monthly Adjustment Amount (IRMAA), which can significantly impact your Medicare expenses. In this article, we'll delve into the world of Medicare premium IRMAA, exploring what it is, how it works, and what you need to know during the open enrollment window.

What is IRMAA?

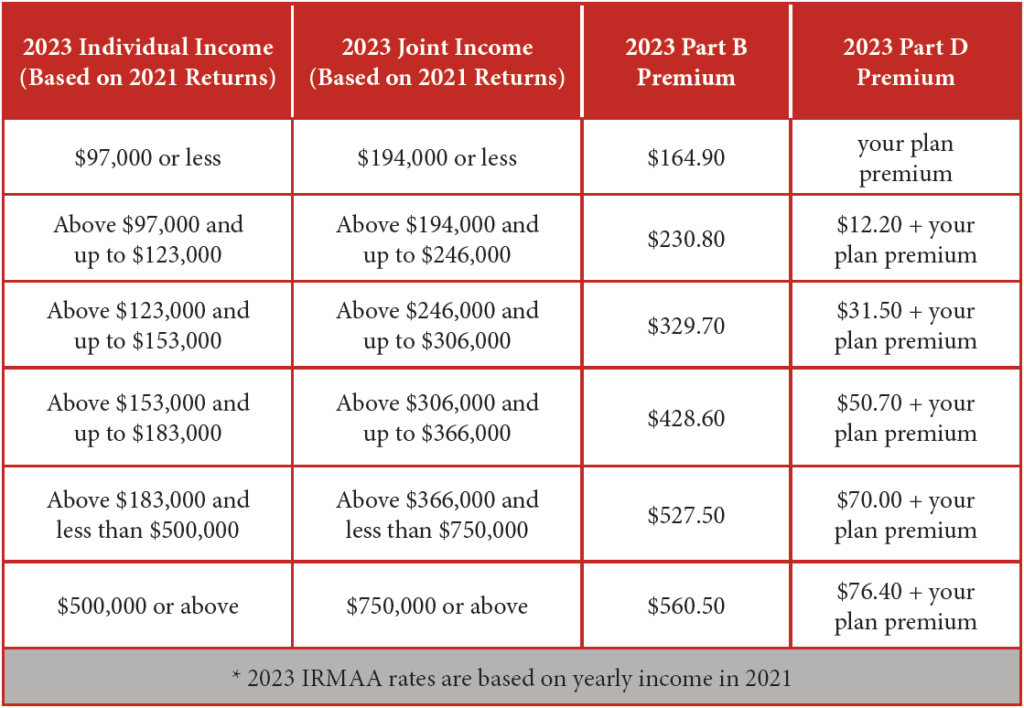

IRMAA is a surcharge added to your Medicare Part B and Part D premiums if your income exceeds certain thresholds. The amount of the surcharge depends on your filing status and income level. The idea behind IRMAA is to ensure that higher-income individuals contribute more to the Medicare program, which helps to sustain the system for all beneficiaries.

How Does IRMAA Work?

To determine your IRMAA, the Social Security Administration (SSA) uses your tax return from two years prior to the current year. For example, in 2023, the SSA will use your 2021 tax return to calculate your IRMAA for 2023. The SSA will look at your Modified Adjusted Gross Income (MAGI), which includes your:

Wages and salaries

Interest and dividends

Capital gains

Business income

Retirement account distributions

If your MAGI exceeds the threshold for your filing status, you'll be subject to the IRMAA surcharge.

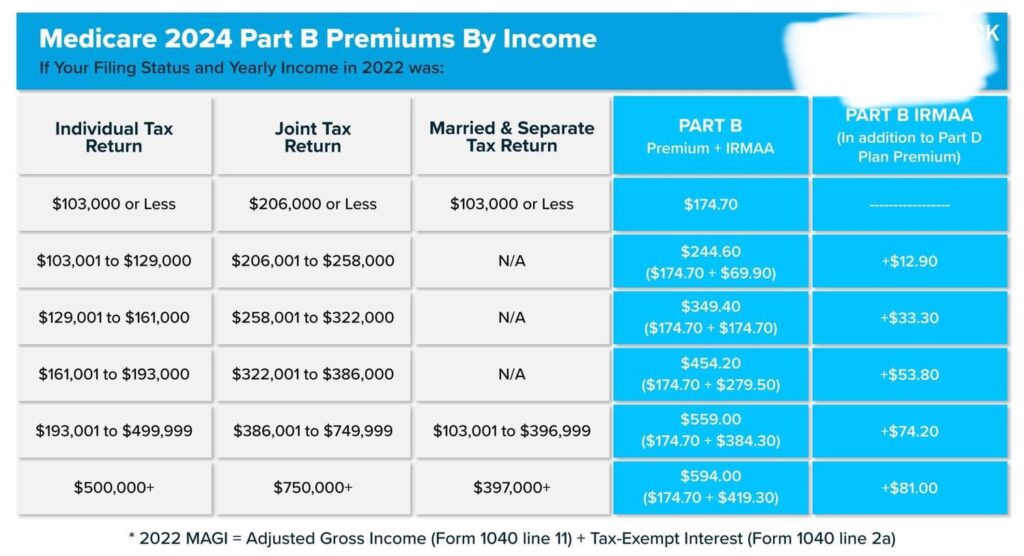

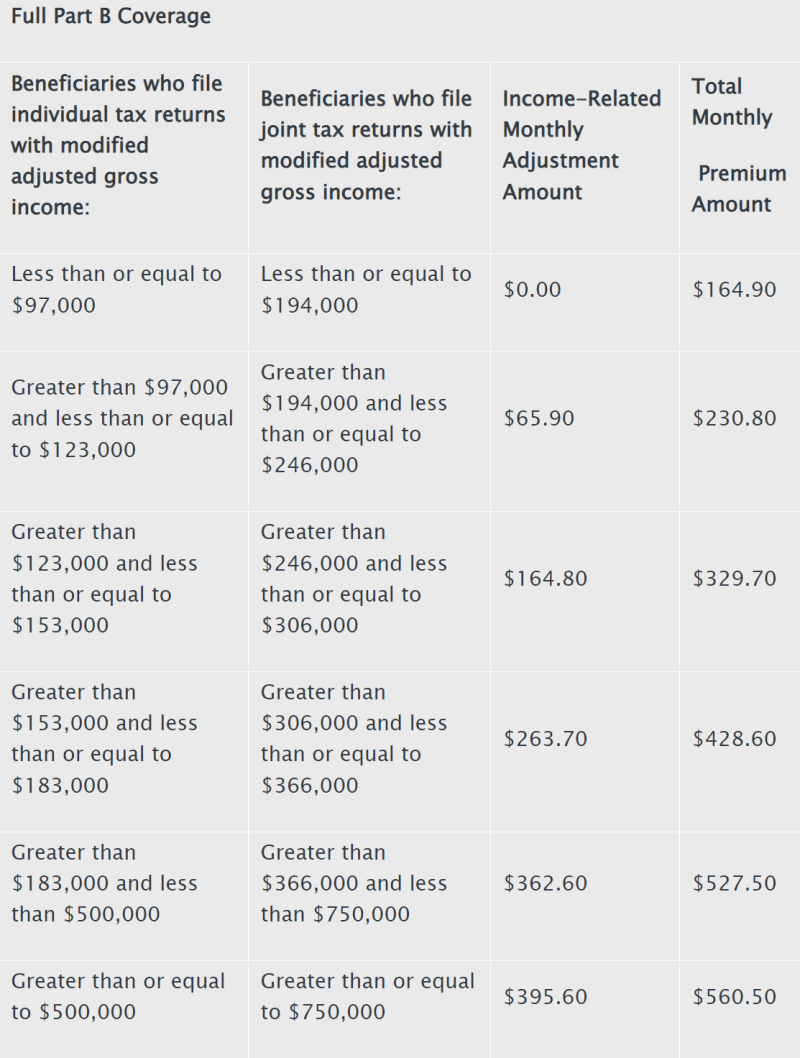

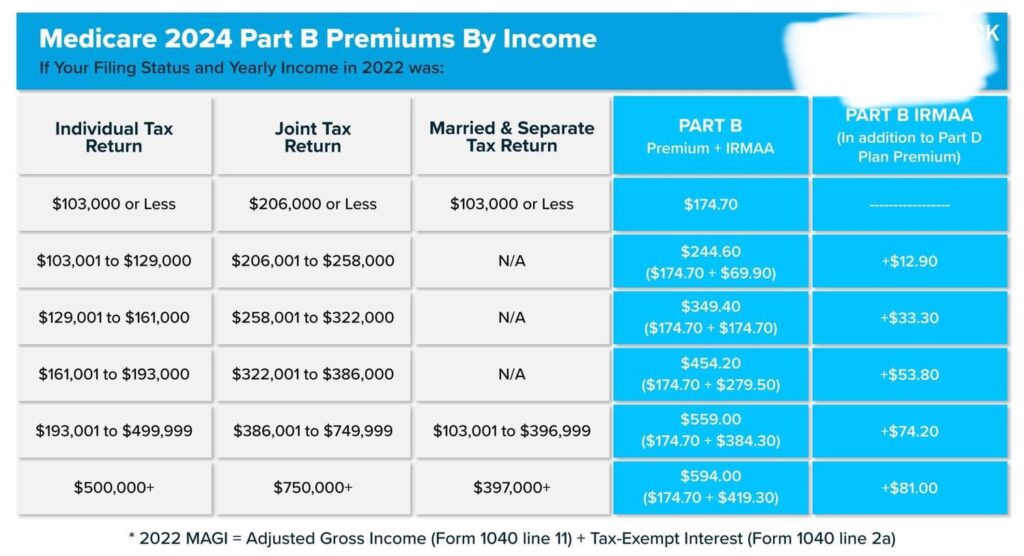

IRMAA Thresholds and Surcharges

The IRMAA thresholds and surcharges for 2023 are as follows:

Single filers:

+ $91,000 or less: No surcharge

+ $91,001 - $114,000: $59.40 per month (Part B) and $12.20 per month (Part D)

+ $114,001 - $142,000: $148.50 per month (Part B) and $31.90 per month (Part D)

+ $142,001 - $170,000: $237.60 per month (Part B) and $51.40 per month (Part D)

+ $170,001 - $216,000: $326.70 per month (Part B) and $70.90 per month (Part D)

+ $216,001 or more: $415.80 per month (Part B) and $90.40 per month (Part D)

Joint filers:

+ $182,000 or less: No surcharge

+ $182,001 - $228,000: $59.40 per month (Part B) and $12.20 per month (Part D)

+ $228,001 - $284,000: $148.50 per month (Part B) and $31.90 per month (Part D)

+ $284,001 - $340,000: $237.60 per month (Part B) and $51.40 per month (Part D)

+ $340,001 - $432,000: $326.70 per month (Part B) and $70.90 per month (Part D)

+ $432,001 or more: $415.80 per month (Part B) and $90.40 per month (Part D)

What to Know During the Open Enrollment Window

During the open enrollment window, which typically runs from October 15 to December 7, you can review and adjust your Medicare coverage. If you're subject to IRMAA, it's essential to consider the following:

Review your income: If your income has changed, you may be eligible for a lower IRMAA surcharge.

Explore Medicare Advantage plans: Some Medicare Advantage plans may offer more affordable premiums, even with the IRMAA surcharge.

Consider a Medicare Supplement plan: Medicare Supplement plans can help cover out-of-pocket costs, including the IRMAA surcharge.

In conclusion, understanding Medicare premium IRMAA is crucial during the open enrollment window. By knowing how IRMAA works and what you can do to minimize its impact, you can make informed decisions about your Medicare coverage and save money on your premiums. Remember to review your income, explore Medicare Advantage plans, and consider a Medicare Supplement plan to ensure you're getting the best coverage for your needs and budget.