Understanding Income Tax Rates in Australia 2024: A Comprehensive Guide by Odin Tax

BlogTable of Contents

- Australian Tax Brackets 2024 Archives - KPG Taxation | Tax Accounting ...

- New Tax Rates Australia 2024 Calculator - Printable Forms Free Online

- What Are The Australian Income Tax Rates For 2024 25 - Printable ...

- Australian Income Tax Rates 2024 25 - Printable Online

- Income Tax Bracket Change 2024au - Sean Winnie

- Australian Tax Brackets in 2024 - Tax Basics for Beginners - YouTube

- Australia Capital Gains Tax Calculator 2025

- Navigating the Australian Tax Brackets in 2024: A Comprehensive Guide

- Australian Income Tax Rates 2024-25 - Rafa Ursola

- Australian Tax Brackets 2024 Archives - KPG Taxation | Tax Accounting ...

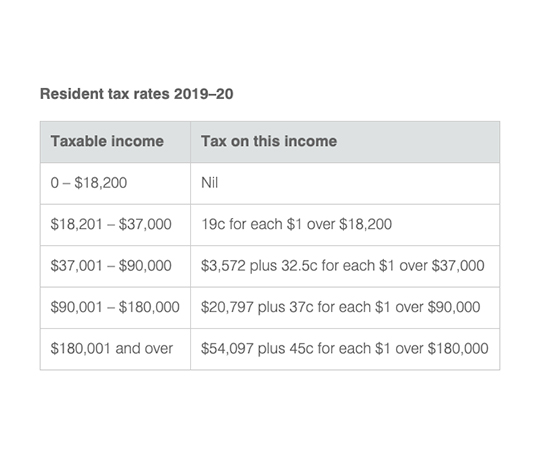

Income Tax Rates in Australia 2024

| Taxable Income | Tax Rate |

|---|---|

| 0 - $18,201 | 0% |

| $18,201 - $45,000 | 19% |

| $45,001 - $120,000 | 32.5% |

| $120,001 - $180,000 | 37% |

| $180,001 and above | 45% |

Changes to Tax Brackets in 2024

How to Calculate Your Income Tax in 2024

Calculating your income tax can be a complex process, but it's essential to ensure you're meeting your tax obligations. Here are the steps to calculate your income tax: 1. Determine your taxable income by subtracting any deductions and exemptions from your gross income. 2. Use the tax tables to determine your tax liability based on your taxable income. 3. Apply any tax offsets or credits you're eligible for to reduce your tax liability. Understanding the income tax rates and brackets in Australia for 2024 is crucial for taxpayers to ensure they're meeting their tax obligations. At Odin Tax, we're committed to providing you with the most up-to-date and accurate information to help you navigate the complex world of taxation. If you have any questions or concerns about your income tax, don't hesitate to contact us. Our team of expert tax professionals is here to help you with all your tax needs.By staying informed and seeking professional advice, you can ensure you're taking advantage of all the tax deductions and credits available to you, minimizing your tax liability, and avoiding any potential penalties. Stay ahead of the game and contact Odin Tax today to discuss your income tax needs.