As a trucking company or owner-operator, navigating the complexities of fuel tax rates can be a daunting task. The International Fuel Tax Agreement (IFTA) aims to simplify the process by providing a uniform system for reporting and paying fuel taxes. In this article, we will delve into the IFTA diesel tax rates by quarter, as provided by Permits Plus Inc, to help you stay on top of your fuel tax obligations.

What is IFTA?

The International Fuel Tax Agreement is a cooperative arrangement between the United States and Canadian provinces to simplify the reporting and payment of fuel taxes. IFTA allows carriers to report and pay fuel taxes to their base jurisdiction, which then distributes the taxes to the respective states or provinces where the fuel was consumed.

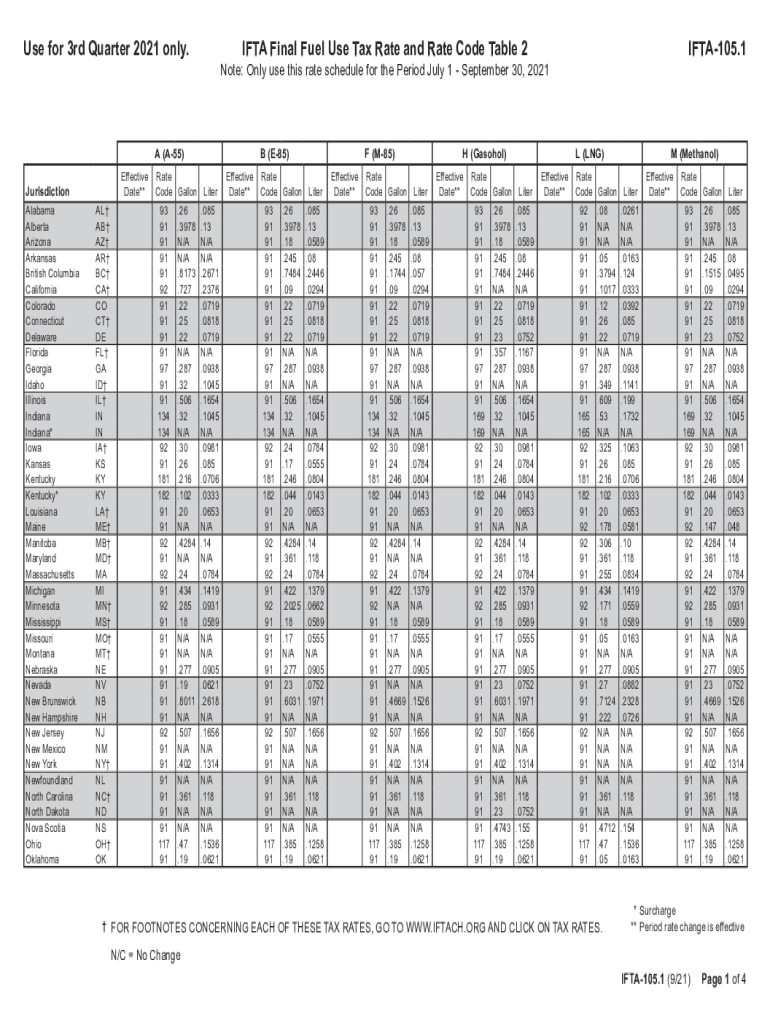

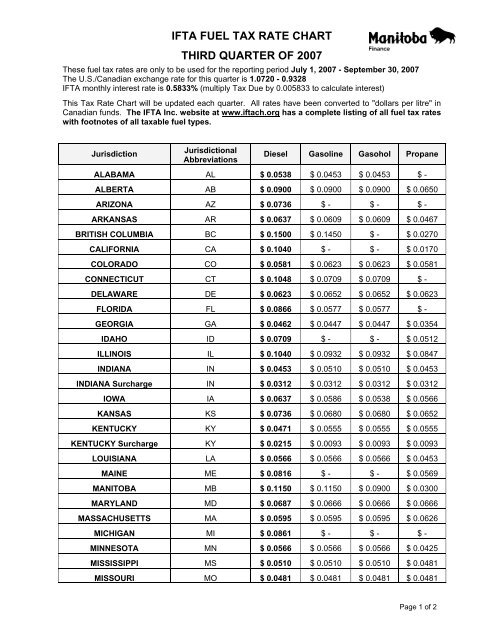

IFTA Diesel Tax Rates by Quarter

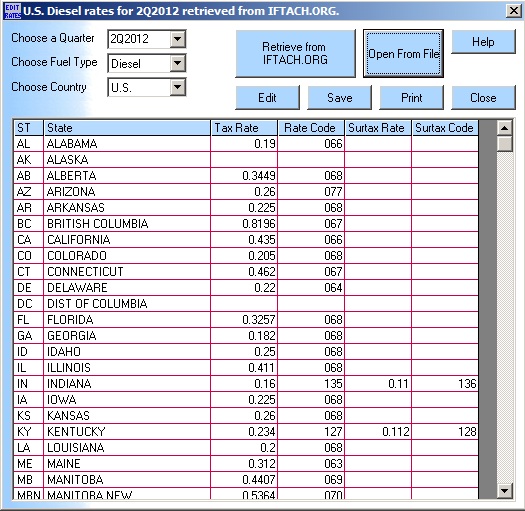

Permits Plus Inc, a leading provider of permitting and fuel tax services, provides quarterly updates on IFTA diesel tax rates. These rates are subject to change and are typically updated in January, April, July, and October of each year. The following table outlines the current IFTA diesel tax rates by quarter:

| Quarter |

State/Province |

Diesel Tax Rate (per gallon) |

| Q1 (January - March) |

Alabama |

0.19 |

| Q1 (January - March) |

California |

0.23 |

| Q2 (April - June) |

Illinois |

0.20 |

| Q2 (April - June) |

Michigan |

0.22 |

| Q3 (July - September) |

New York |

0.24 |

| Q3 (July - September) |

Ontario |

0.26 |

| Q4 (October - December) |

Florida |

0.21 |

| Q4 (October - December) |

Texas |

0.20 |

Why Accurate IFTA Reporting Matters

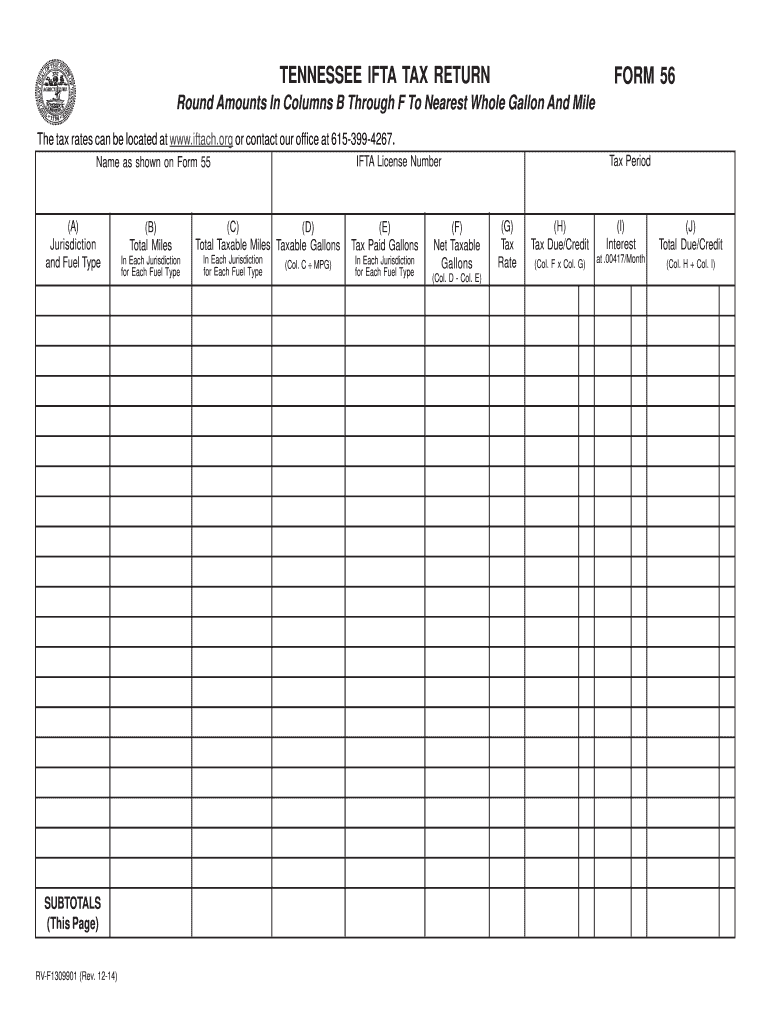

Accurate IFTA reporting is crucial to avoid penalties, fines, and interest on underpaid or overpaid taxes. Carriers must maintain detailed records of fuel purchases, mileage, and tax rates to ensure compliance with IFTA regulations. Permits Plus Inc offers expert guidance and support to help carriers navigate the complexities of IFTA reporting and ensure accurate tax payments.

Understanding IFTA diesel tax rates by quarter is essential for trucking companies and owner-operators to manage their fuel tax obligations effectively. By staying up-to-date with the latest tax rates and regulations, carriers can avoid costly penalties and ensure compliance with IFTA requirements. Permits Plus Inc is a trusted partner for all your permitting and fuel tax needs, providing expert guidance and support to help you navigate the complexities of IFTA reporting.

For more information on IFTA diesel tax rates and to stay current with the latest updates, visit

Permits Plus Inc today. Our team of experts is dedicated to helping you stay compliant and avoid costly penalties. Contact us now to learn more about our IFTA reporting services and how we can support your trucking business.