Streamline Your Tax Filing with Intuit's Comprehensive PDF Tax Preparation Checklist

BlogTable of Contents

- Canadian Income Tax Checklist 2024

- Who Is Mrs America 2024 Season - Kial Bernadene

- Sandstone Point Hotel Map 2024 Map - Edee Nertie

- 2024 Grammys Channel 6 - Edee Nertie

- Tax Prep Checklist 2024 - Ivett Letisha

- Hate Cannot Drive Out Hate Only Love - Edee Nertie

- Gift Tax Deduction 2025 - Edee Kettie

- Endings and beginnings: Year-end tax reminders and tax changes in 2023 ...

- Tax Return Checklist,tax Prep,tax Deductions,tax Prep Checklist,tax Log ...

- Wedding Planner 2024 2025 2026 checklist Perancangan Kahwin Pengantin ...

What is Intuit's PDF Tax Preparation Checklist?

Benefits of Using Intuit's PDF Tax Preparation Checklist

What's Included in Intuit's PDF Tax Preparation Checklist?

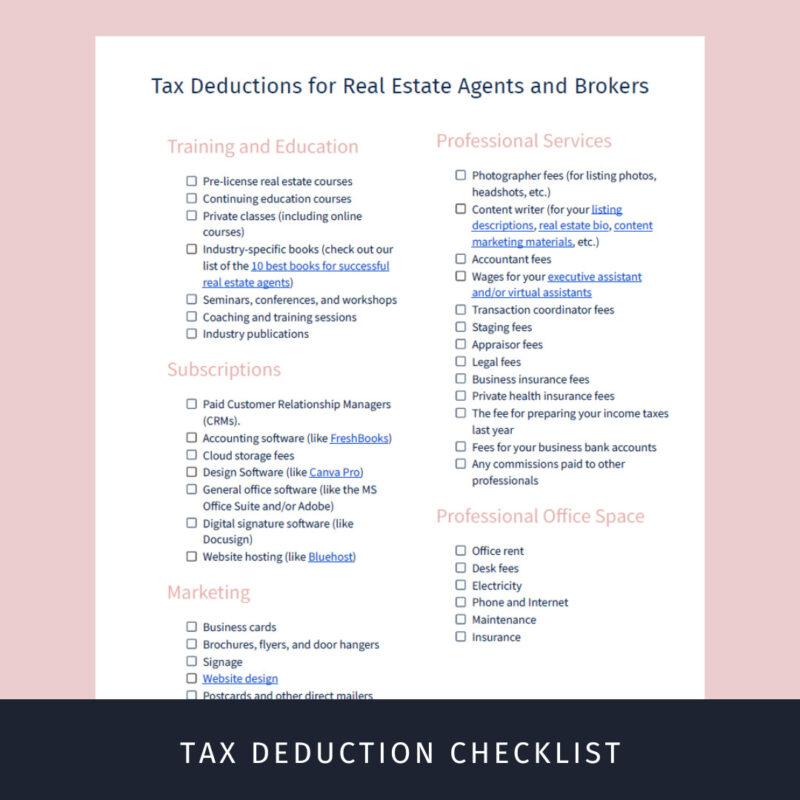

Intuit's PDF tax preparation checklist is a comprehensive document that covers various aspects of tax preparation. Some of the key areas included in the checklist are: Income: W-2s, 1099s, interest statements, and other income-related documents. Deductions: Charitable donations, medical expenses, mortgage interest, and other deductible expenses. Credits: Earned Income Tax Credit (EITC), Child Tax Credit, and other tax credits. Business Income: Business income statements, expense records, and other business-related documents. Other Relevant Information: Dependents, education expenses, and other relevant information.

How to Use Intuit's PDF Tax Preparation Checklist

Using Intuit's PDF tax preparation checklist is straightforward. Simply download the document, print it out, and start gathering the necessary documents and information. As you collect each document, check it off on the list to ensure you stay organized and on track. In conclusion, Intuit's PDF tax preparation checklist is a valuable resource that can help you streamline your tax preparation and filing process. By using this comprehensive checklist, you can ensure accuracy, organization, and compliance, giving you peace of mind and minimizing the risk of errors and penalties. Download Intuit's PDF tax preparation checklist today and take the first step towards a stress-free tax season.For more information on tax preparation and filing, visit Intuit's website or consult with a tax professional. Stay ahead of the tax season and ensure a smooth and efficient filing process with Intuit's PDF tax preparation checklist.