As a business owner or accountant, managing payroll can be a daunting task, especially when it comes to staying on top of deadlines and ensuring compliance with tax regulations. To simplify the process, QuickBooks offers a range of payroll calendar templates for 2025-2026 that can help you stay organized and ensure timely payments to your employees. In this article, we'll explore the benefits of using QuickBooks payroll calendar templates and provide you with the tools you need to get started.

What are Payroll Calendar Templates?

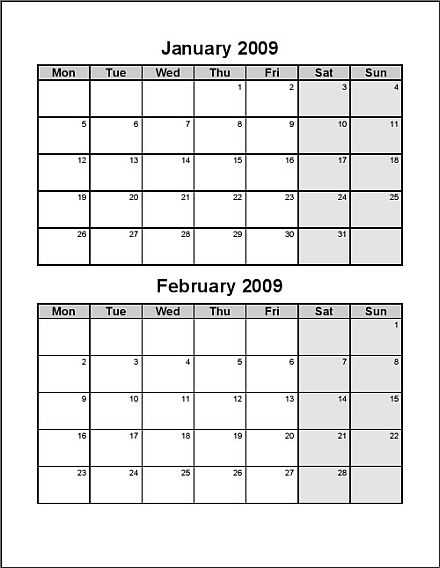

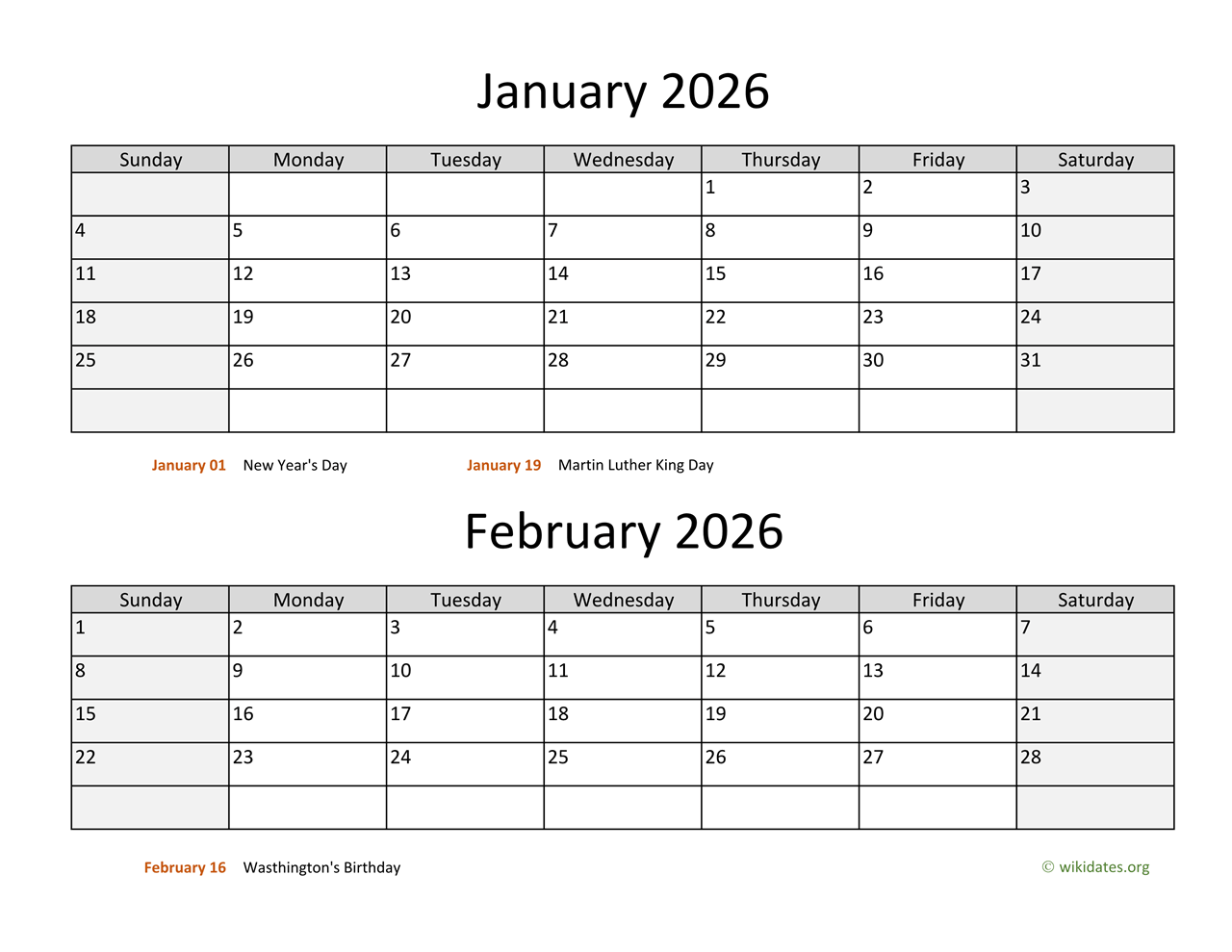

Payroll calendar templates are pre-designed spreadsheets that help you track and manage your payroll schedule, including pay periods, pay dates, and deadlines for tax filings and payments. These templates are typically designed to be compatible with popular accounting software like QuickBooks, making it easy to integrate them into your existing payroll system.

Benefits of Using QuickBooks Payroll Calendar Templates

Using QuickBooks payroll calendar templates can bring numerous benefits to your business, including:

Improved accuracy: By using a template, you can reduce the risk of errors and ensure that your payroll schedule is accurate and up-to-date.

Increased efficiency: With a template, you can quickly and easily track pay periods, pay dates, and deadlines, saving you time and reducing the administrative burden of managing payroll.

Enhanced compliance: QuickBooks payroll calendar templates are designed to help you stay compliant with tax regulations and deadlines, reducing the risk of penalties and fines.

Better cash flow management: By tracking pay periods and pay dates, you can better manage your cash flow and ensure that you have sufficient funds to meet your payroll obligations.

Features of QuickBooks Payroll Calendar Templates for 2025-2026

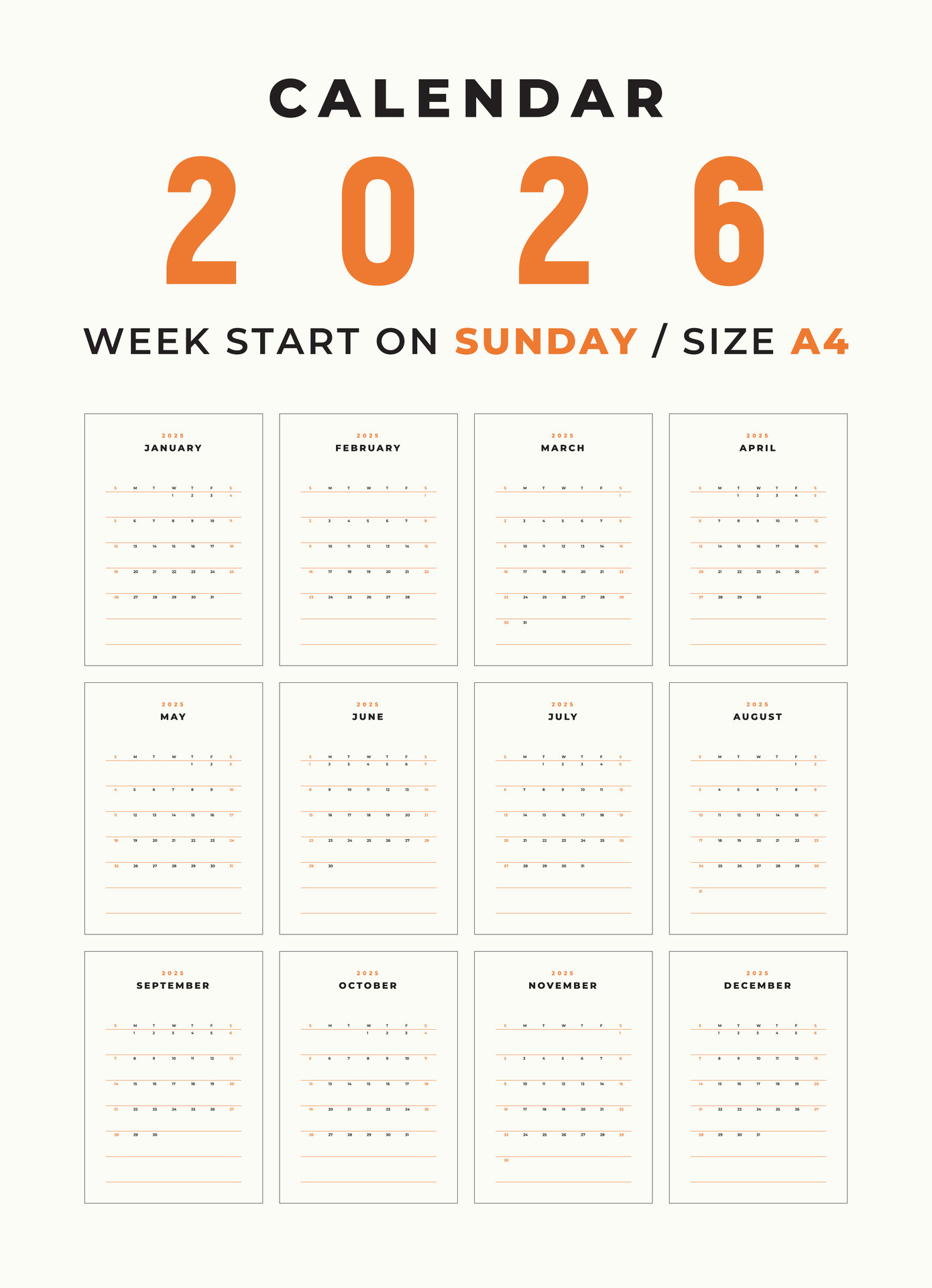

QuickBooks payroll calendar templates for 2025-2026 offer a range of features, including:

Pre-designed templates: Choose from a range of pre-designed templates that are tailored to your specific business needs.

Customizable: Easily customize the template to fit your business's unique payroll schedule and needs.

Integrates with QuickBooks: Seamlessly integrate the template with your QuickBooks accounting software.

Automatic calculations: The template will automatically calculate pay periods, pay dates, and deadlines, reducing the risk of errors.

How to Get Started with QuickBooks Payroll Calendar Templates

Getting started with QuickBooks payroll calendar templates is easy. Simply:

Download the template: Download the QuickBooks payroll calendar template for 2025-2026 from the QuickBooks website.

Customize the template: Customize the template to fit your business's unique payroll schedule and needs.

Integrate with QuickBooks: Integrate the template with your QuickBooks accounting software.

Start tracking your payroll: Start using the template to track your payroll schedule, pay periods, and deadlines.

By using QuickBooks payroll calendar templates for 2025-2026, you can streamline your payroll process, reduce errors, and ensure compliance with tax regulations. With its range of features and benefits, these templates are an essential tool for any business owner or accountant looking to simplify their payroll management. So why wait? Get started today and take the first step towards a more efficient and accurate payroll process.