Maximizing Your Retirement Savings: 401(k) Contribution Limits in 2025

BlogTable of Contents

- The Maximum 401(k) Contribution Limit For 2020 Goes Up By 0

- 401(k) Contribution Limits In 2024 And 2025 | Bankrate

- 401(k) Contribution Limits In 2024 And 2025 | Bankrate

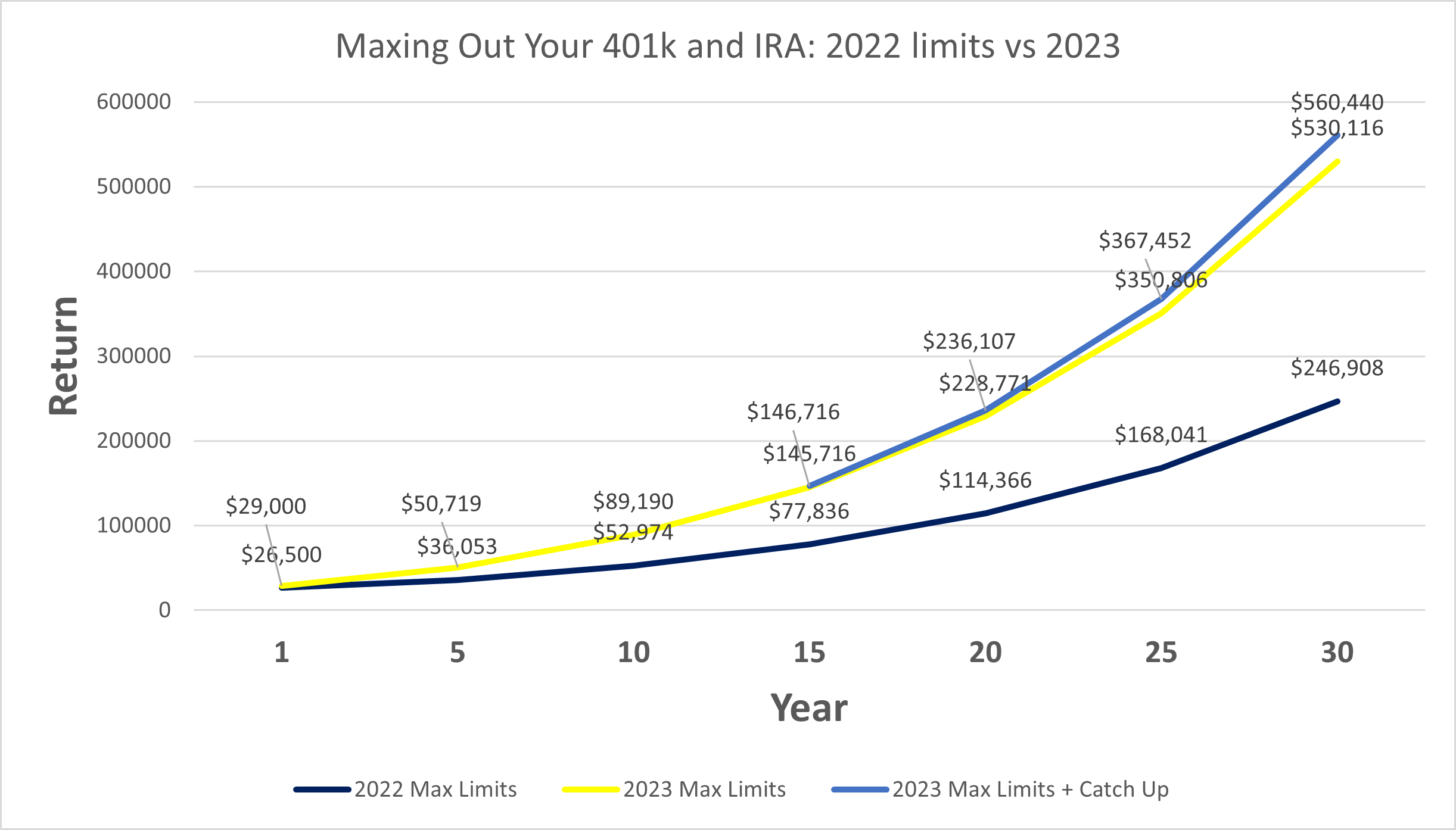

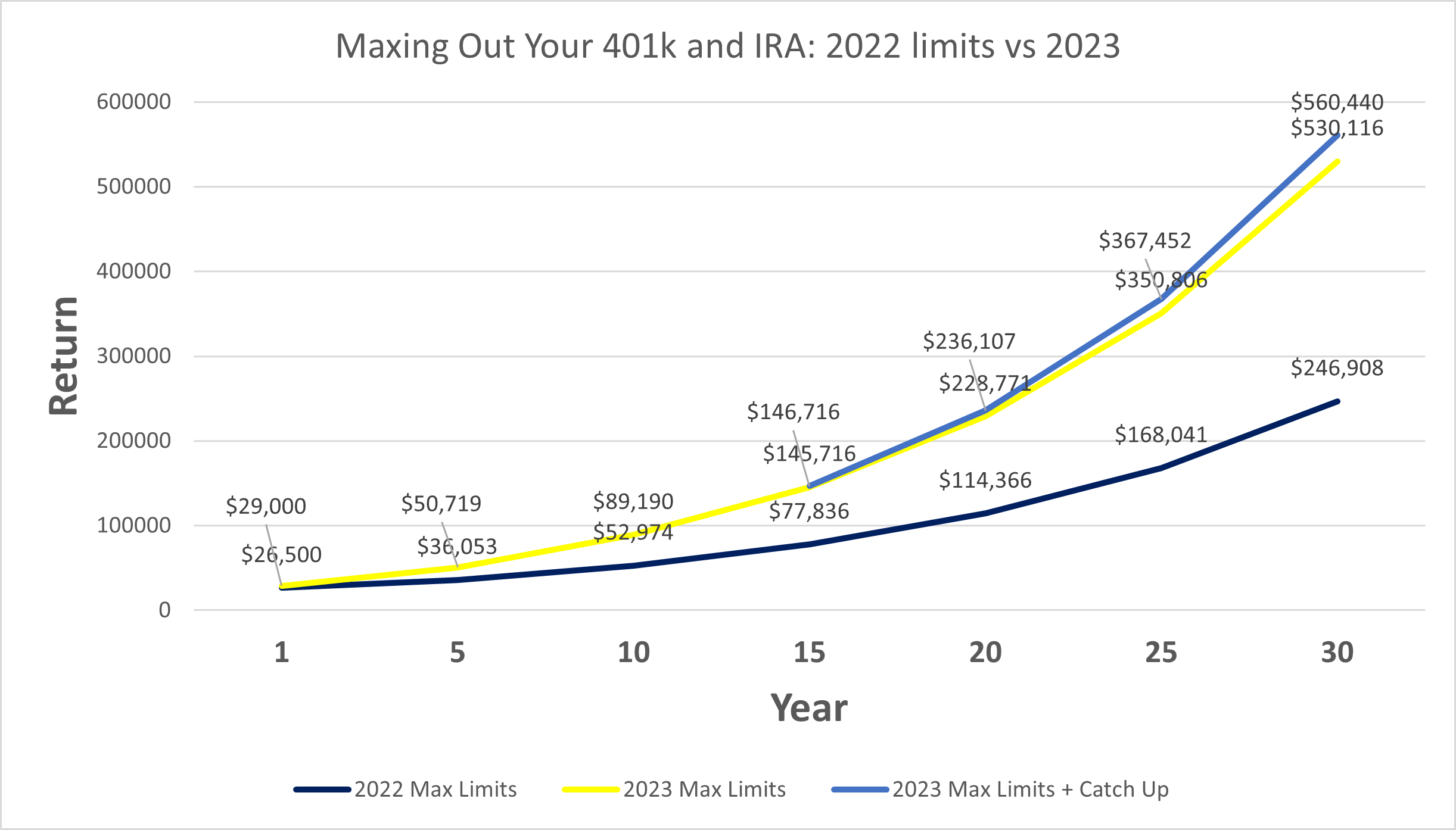

- New 401(k) and IRA Limits Could Equal an Additional 300k in Your Pocket ...

- Retirement plans are changing in 2025: What to know - ABC News

- Catch-Up Contributions Into a Roth 401(k) Isn't a Bad Idea | Kiplinger

- My Company Said 401(k) Contributions Are Based on Straight Time Pay

- Catch-Up Contributions Into a Roth 401(k) Isn't a Bad Idea | Kiplinger

- 401(k) catch-up limits in 2025 allow bigger contribution for some

- New 401(k) and IRA Limits Could Equal an Additional 300k in Your Pocket ...

What are the 401(k) Contribution Limits in 2025?

:max_bytes(150000):strip_icc()/Individual-Roth-401k-Plan-56a093553df78cafdaa2d8e7.jpg)

How Do 401(k) Contribution Limits Work?

Benefits of Maximizing 401(k) Contributions

Maximizing 401(k) contributions can have significant benefits for your retirement savings. Some of the advantages include: Tax Benefits: Contributions to traditional 401(k) plans are tax-deductible, reducing your taxable income. Compound Interest: The earlier you start contributing, the more time your money has to grow, thanks to compound interest. Employer Matching: Many employers offer matching contributions, which can essentially give you free money for your retirement. In conclusion, the 401(k) contribution limits in 2025 offer a great opportunity to maximize your retirement savings. By understanding the limits and how they work, you can make informed decisions about your 401(k) plan and take advantage of the benefits it provides. Remember to consult with a financial advisor or tax professional to ensure you're making the most of your retirement plan.Stay ahead of the game and start planning your retirement savings strategy today. With the right knowledge and planning, you can secure a comfortable and prosperous retirement.

Note: The information provided in this article is subject to change and may not reflect the current laws or regulations. It's essential to consult with a financial advisor or tax professional for personalized advice on 401(k) contribution limits and retirement planning. Keyword: 401(k) contribution limits, retirement savings, IRS guidelines, 2025 limits, catch-up contributions, elective deferrals, employer contributions, tax benefits, compound interest, employer matching.