Amazon Stock Price Update: A Comprehensive Overview of AMZN's Current Performance

BlogTable of Contents

- Breakout Alert: Amazon.com, Inc. Stock Could Surge Over ,500

- A Developer’s Guide To Financial Investments | Pentacode

- amazon-stock-price - Housing Forecasts & Stock Market Forecast

- Amazon Stock Price and News: Why are Amazon (AMZN) shares up today?

- Amazon stock price prediction 2023, 2025: Is Amazon a good stock to buy?

- Tech-Averse Warren Buffett's Company Wolfs 0 Million in AMZN Stock

- Ahead of Earnings, Is Amazon Stock a Buy? | Morningstar

- Amazon.com, Inc. (AMZN) Stock Got Hit — Consider It A Buying Opportunity

- Amazon Stock Price

- Amazon Stock Market editorial photo. Image of warehouse - 242549751

As one of the world's largest and most influential technology companies, Amazon.com Inc. (AMZN) is constantly under the spotlight. The company's stock price is closely watched by investors, analysts, and industry experts, and for good reason. With a market capitalization of over $1 trillion, Amazon's stock performance has a significant impact on the overall market. In this article, we will provide an update on Amazon's stock price today, as reported by the Wall Street Journal (WSJ), and offer insights into the company's current performance.

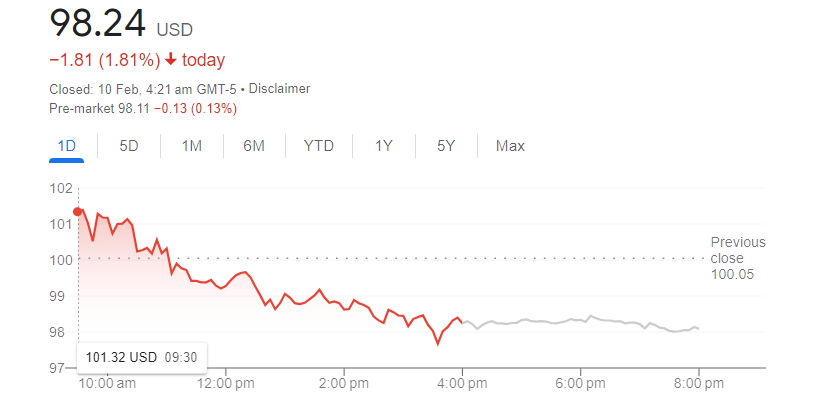

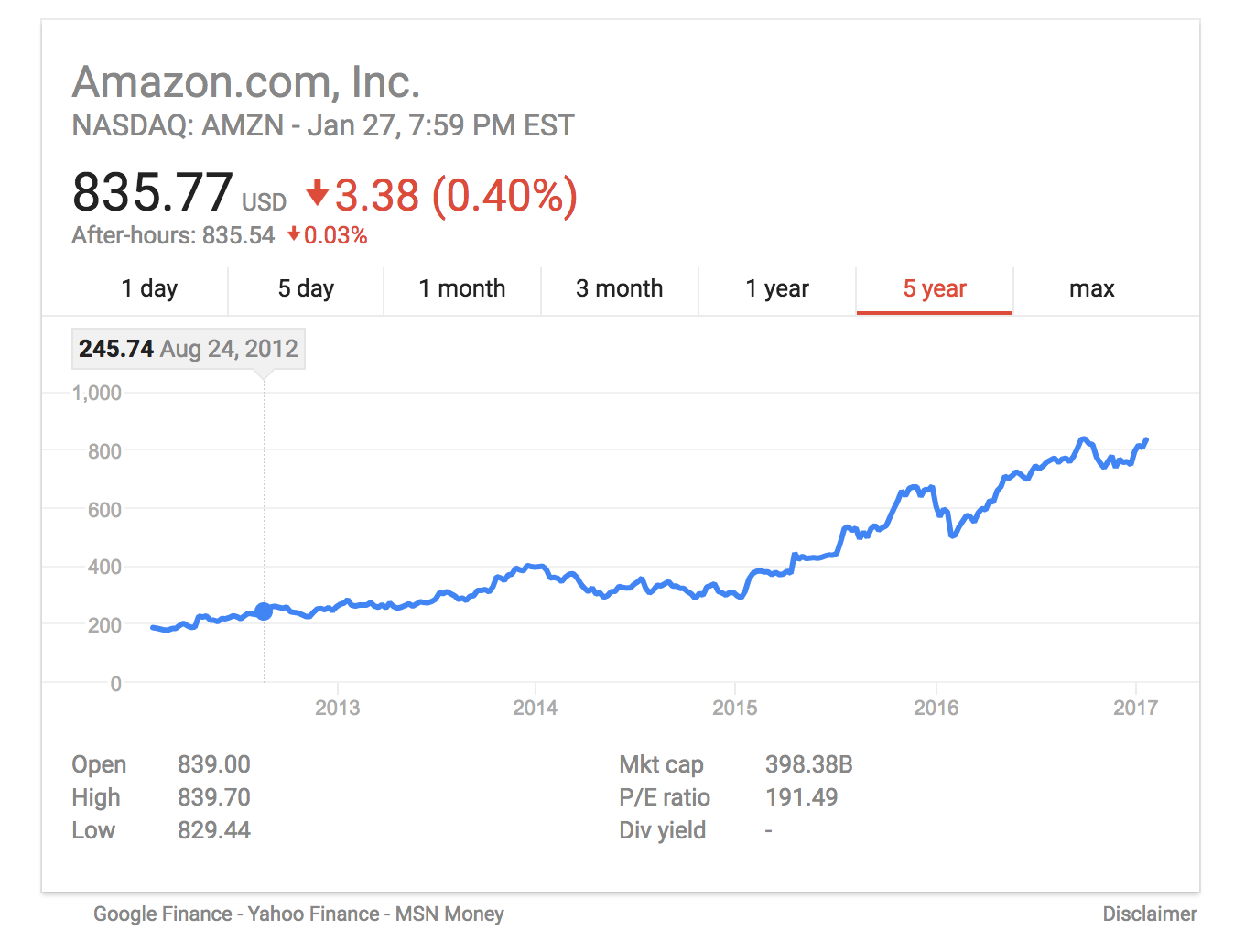

Current Stock Price

As of today, Amazon's stock price is available on the WSJ website. According to the latest data, AMZN is trading at around $3,100 per share, with a market capitalization of over $1.2 trillion. The stock has experienced a significant increase in value over the past year, with a year-to-date return of over 20%.

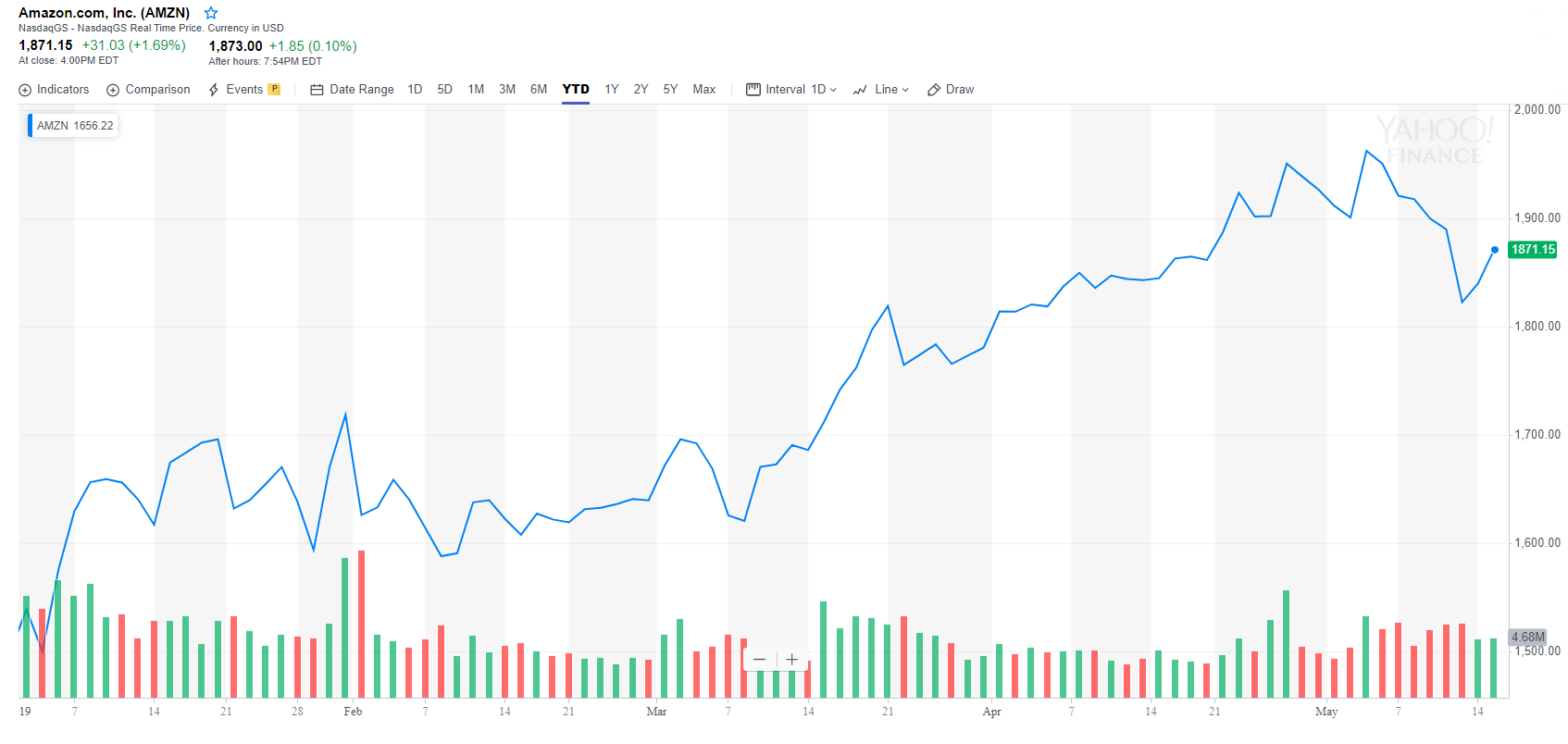

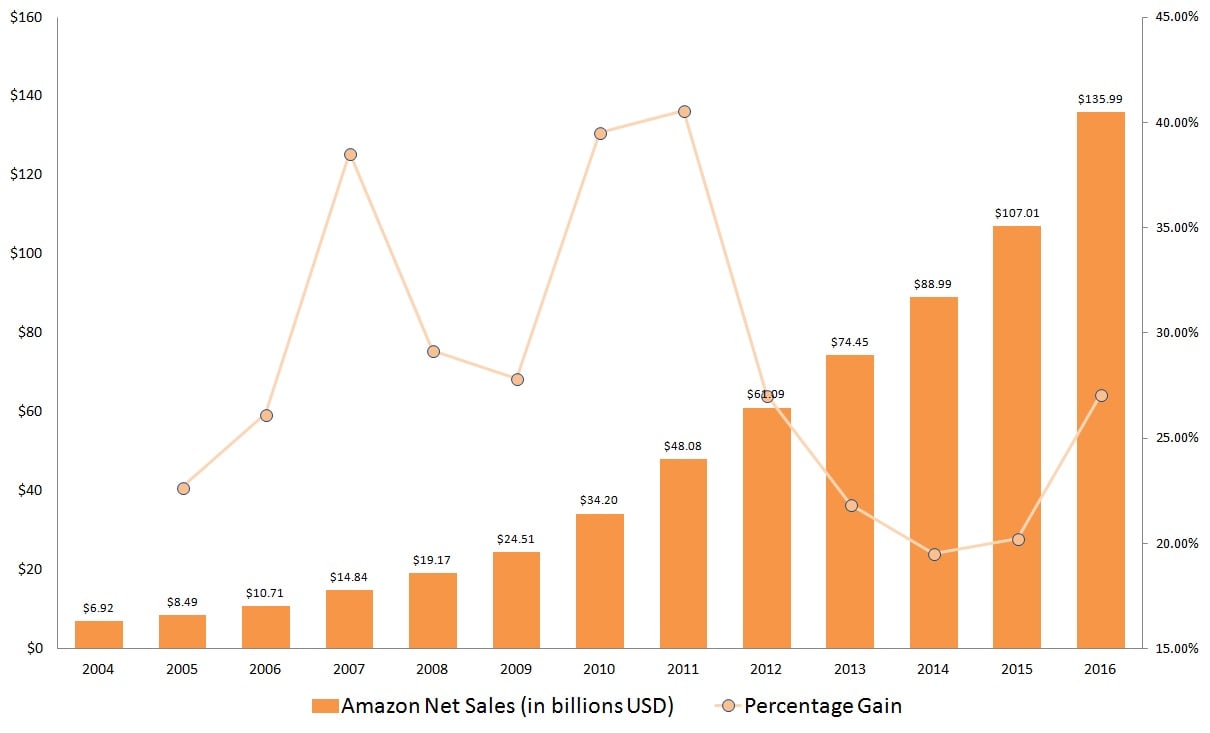

Recent Performance

Amazon's recent performance has been impressive, with the company reporting strong revenue growth and expanding its presence in various markets. The company's e-commerce platform continues to dominate the online retail space, with a market share of over 40% in the United States. Additionally, Amazon's cloud computing business, Amazon Web Services (AWS), has experienced significant growth, with revenue increasing by over 30% year-over-year.

Analyst Expectations

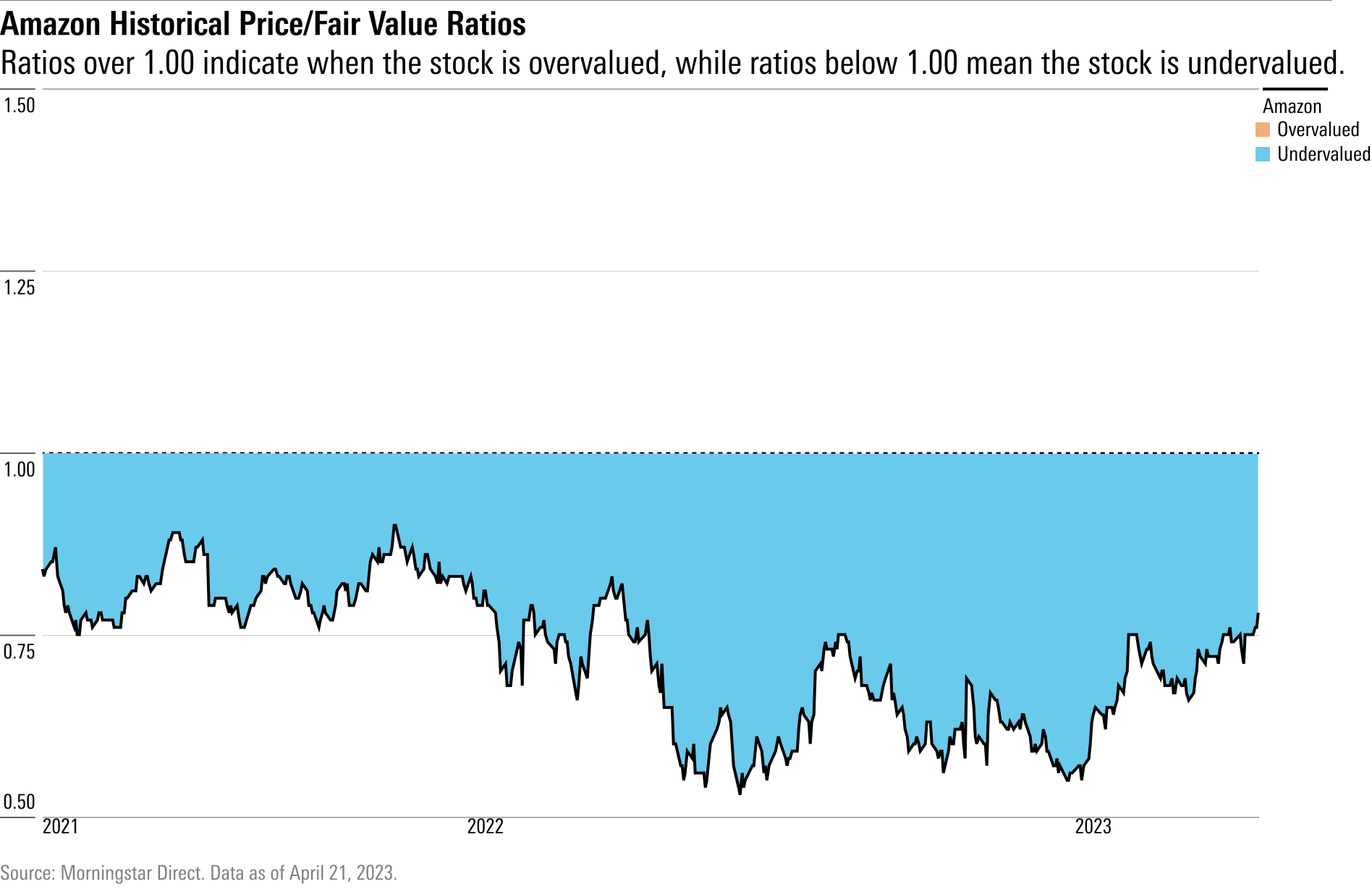

Analysts expect Amazon's stock price to continue to rise in the coming months, driven by the company's strong financial performance and growing presence in emerging markets. According to a recent survey by the WSJ, the average analyst price target for AMZN is around $3,500 per share, representing a potential upside of over 10% from current levels.

Risks and Challenges

While Amazon's stock price has been performing well, there are risks and challenges that investors should be aware of. The company faces intense competition in the e-commerce and cloud computing spaces, and regulatory scrutiny is increasing. Additionally, Amazon's high valuation multiples may make the stock vulnerable to a correction if the company's growth slows down.

In conclusion, Amazon's stock price today is a reflection of the company's strong financial performance and growing presence in various markets. While there are risks and challenges that investors should be aware of, the company's long-term growth prospects remain promising. As always, investors should do their own research and consult with a financial advisor before making any investment decisions. For the latest updates on Amazon's stock price, visit the WSJ website.

Stay up-to-date with the latest news and analysis on Amazon and other stocks by following our blog. We provide regular updates on market trends, company performance, and investment opportunities.

Disclaimer: This article is for informational purposes only and should not be considered as investment advice. The author and publisher are not responsible for any losses or gains resulting from the information provided.